According to the real estate site Redfin, the median sale price of a home in Phoenix is down almost 5% from a year ago. Housing demand is falling, but spring typically marks a rise in demand. So the question is: Will the market stabilize or continue to tumble? The data indicates that either scenario is possible.

The median sale price for homes in Phoenix peaked in June of last year at $470,000. Since then, the price has dropped precipitously, increasing by only a small amount in one of the eight months. The latest Redfin data shows the median sales price at $403,000, a 14% drop from the peak.

According to the Case Shiller index, there are three pivotal points in the year-over-year changes; 2004, the price runup that began the great recession, 2011 during the recovery phase, and 2020. Phoenix is a more volatile market that frequently has higher highs and lower lows compared to the national index.

Data after 2020 shows the year-over-year change in Phoenix dropped below the national Case Shiller index. This is a big measure to watch since it is a rare occurrence. The next few months, with their typically higher demand, will indicate if prices stabilize or if the market is headed for a crash.

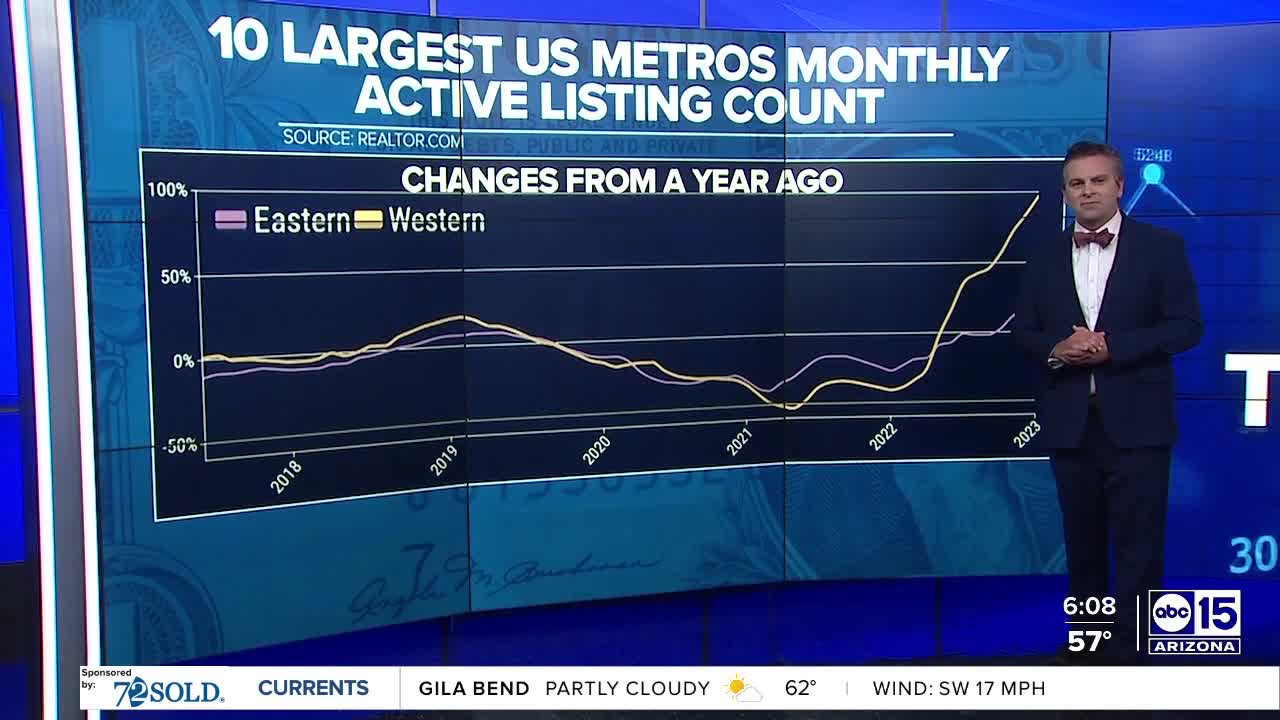

There are several differences between now and the housing market crash of the mid-2000s. Lending standards are better and there is less housing inventory overall. Data from realtor.com shows that active listings in the 10 largest U.S. metros is lower than it was in 2019.

Total inventories don’t tell the whole story, however. An analysis of the market done by Lorenzo Batarello, a finance analyst that puts his findings on Youtube, found that if the 10 largest metros are split by region, there is a major divergence between eastern and western cities. Active listings in the five largest western metropolitan areas are up 97% compared to last year. Eastern metros meanwhile are up a more modest 24%.

It remains unclear if housing markets will stabilize or crash, but it is likely that Phoenix and other western markets will be expanding inventories and dropping prices. The next few months will be a crucial test.